Originally conceptualized by the Economic Innovation Group (EIG) in 2015 and established by Congress in the Tax Cuts and Jobs Act of 2017, the opportunity zone program was created to stimulate economic growth in designated low-income communities in return for capital gains tax breaks. Opportunity zones are designated low-income census tracts with a poverty rate of 20% or a median family income of up to 80% of the area median. There are 8,762 opportunity zones spanning all fifty states and five U.S. territories (American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the Virgin Islands).

Source: EIG.org

The goal of the program is to improve the economic conditions of low-income communities by incentivizing long-term private capital investment. There is $6.1 trillion of individual ($3.8 trillion) and corporate ($2.3 trillion) unrealized capital gains that can be deployed into opportunity funds. Spreading wealth to grow these local economies will surely have a positive impact on many of the 35 million people who call these communities home.

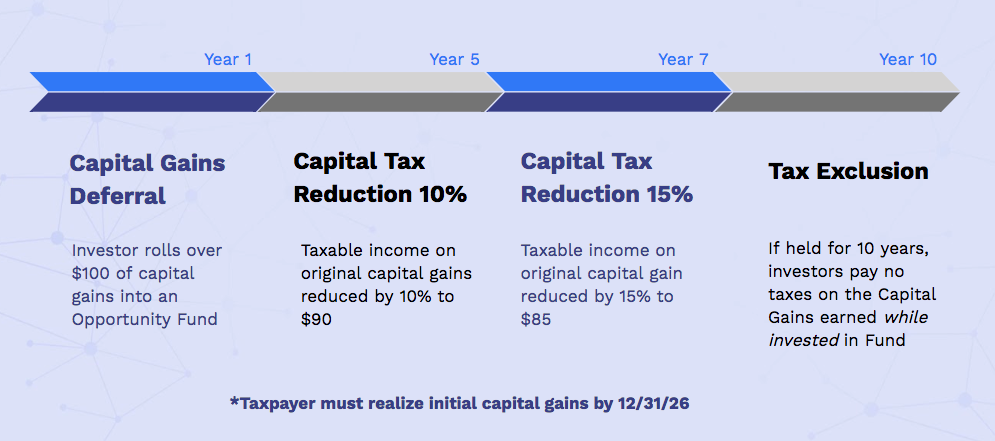

By deploying capital gains earned from the sale/exchange of any asset (real estate, art, bitcoin, etc.) into a Qualified Opportunity Fund (QOF), investors are able to defer, and potentially reduce, capital gains taxes. An additional tax benefit to be aware of is the ability to exclude all taxes on capital gains earned on interest in the opportunity fund if held for 10 years. Investments in Qualified Opportunity Zones (QOZ) are done so through a QOF, which must invest at least 90% of assets into QOZ. Any eligible taxpayers such as individuals, C corps (RICs & REITs), S corps, partnerships, trusts, and estates are able to create or invest in qualified opportunity funds. Below is a visual to help further understand.

ALSO READ: Where should you be putting your cryptocurrency gains? Opportunity Zones.

The opportunity zone program was designed with three favorable tax incentives for investors to encourage participation. The tax incentives offered by the Opportunity Zone Program include:

Example:

A QOF is an investment vehicle (corporate or partnership entity) established for the purpose of investing in Qualified Opportunity Zone Property (QOZP). QOZP consists of stock, partnership interests, and business property and excludes sin businesses (liquor stores, strip clubs, casinos, massage parlors, racetracks, golf courses, etc). If you were seeking to create your own qualified opportunity fund, you would fill out Form 8996 and self-certify. A QOF must invest at least 90% of its assets in QOZP. For each month it fails to meet the 90% requirement, the fund must pay a penalty.

The Opportunity Zone Program is designed to stimulate economic development and employment creation in low-income communities by incentivizing long-term private capital investment. With an estimated $6 trillion in unrealized capital gains, there is astounding potential for distressed communities across the country to benefit. This program will enable investors to put their capital to work and accelerate economic growth in distressed communities across the country, while also taking advantage of tax incentives.

Read our views what's going on in the blockchain and alternative investments industries, gain insights from our team of experts, and find out more about RealBlocks!