The Opportunity Zone Program is designed to stimulate economic development and employment creation in low-income communities by incentivizing long-term private capital investment. This program will enable investors to put their capital gains to work and accelerate economic growth in distressed communities across the country, while also taking advantage of tax incentives. For example, gains from the sale of art, stock, bonds all qualify for tax incentives if rolled over into an opportunity fund within the 180 day time period. Additionally, capital gains from bitcoin, or other cryptocurrencies, can also be rolled over into an opportunity fund, which is an enticing offer for many crypto holders.

While the decline of the cryptomarket has been much publicized over the past months, there are still many individuals who have been holding since long before the crypto-frenzy took a firm hold on the cultural and economic zeitgeist. However, there still lies potential for investors to accumulate gains from the cryptomarket in the future... and for those crypto holders looking to diversify their holdings and benefit from massive tax incentives, opportunity funds may be the right investment.

Opportunity zones are economically distressed communities designated by the state, certified by Secretary of US Treasury and IRS. There are 8,762 opportunity zones spanning all fifty states and five U.S. territories (American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the Virgin Islands).

For more information, view the IRS FAQs.

See below for a map of current designated opportunity zones:

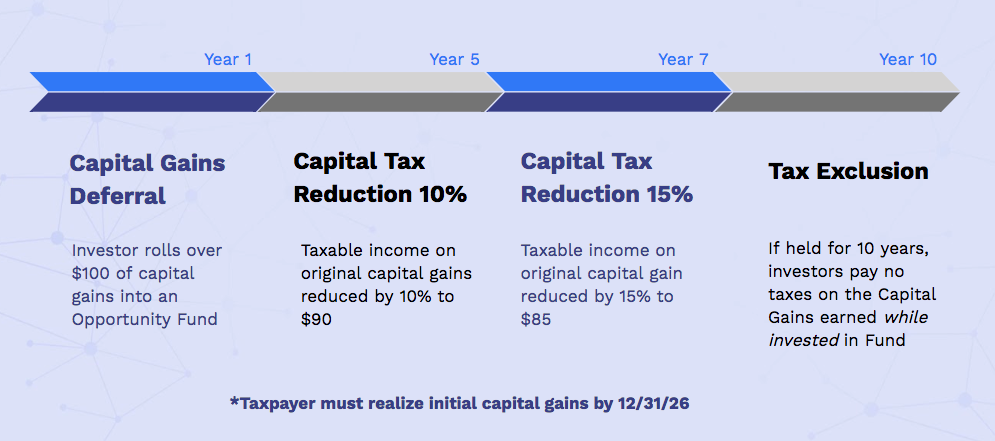

By deploying capital gains earned from the sale/exchange of any asset (real estate, art, bitcoin, etc.) into a Qualified Opportunity Fund, investors are able to defer, and potentially reduce, capital gains taxes.

A Qualified Opportunity Fund is an investment vehicle (corporate or partnership entity) established for the purpose of investing in Qualified Opportunity Zone Property, which consists of stock ownership, partnership interest, or business property.

The opportunity zone program was designed with three favorable tax incentives for investors to encourage participation. The tax incentives offered by the Opportunity Zone Program include:

Example:

A popular option to defer capital gains among the real estate community is through a “1031 exchange”. On a high level, this option gives real estate investors the ability to defer capital gains by deploying the proceeds from the sale of their investment property into a “like-kind” property within 180 days.

The opportunity zone program is similar to this in that capital gains can be deferred, however the gains are not limited to only real estate investment properties. In fact, the OZ program was intentionally designed for investors to defer, and potentially reduce, capital gains on any appreciated assets into designated opportunity zones. The amount of unrealized capital gains in the U.S. is estimated to be $6.1 trillion. Spreading this wealth into opportunity zones has tremendous potential to improve both economically distressed areas around the country as well as investor’s returns.

Taxes of Cryptocurrency Gains

According to a notice by the IRS, “Virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.” In layman terms, you realize capital gains (and losses) at fair market value at the time of the event when you trade, sell, or use crypto. For example, trading crypto to crypto or crypto to fiat.

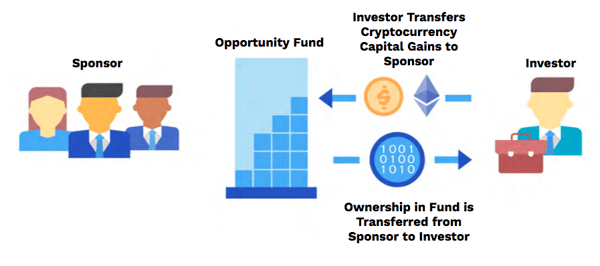

Opportunity zones are a nascent space at the moment as funds are in the process of raising capital and analyzing investment opportunities across the country. At RealBlocks, we are working with our partners and building architecture to allow for the acceptance of cryptocurrency gains into opportunity funds. By doing so, cryptocurrency holders (domestic and international) will seamlessly be able to invest into U.S. real estate and businesses in potentially high growth areas.

Here's how a typical transaction may go:

By utilizing our platform, investors can take gains from BTC or ETH and make investments into opportunity funds. They will receive the tax benefits offered by the opportunity zone program as long as the gains are rolled over within 180 days of the sale/exchange. (Investors must indicate on their tax return, via form 8949 , that they have rolled over their gains into an opportunity fund.)

The BTC or ETH invested is then converted on the back-end ensuring the opportunity fund sponsor receives USD. Investor is issued a token, representing their pro rata share of the opportunity fund they invested in.

The Opportunity Zone Program may be in its early stages, but with Americans holding onto $6.1 trillion in unrealized capital gains, it's clear that the potential for investment is huge. Investors of all kinds have shown immense interest in the program, though crypto holders may be especially excited about the prospect of deferring their capital gains into a more steady asset class.

As the team at RealBlocks continues work with our partners, we will update individuals on new and innovative ways to invest their capital in these exciting projects.

Read our views what's going on in the blockchain and alternative investments industries, gain insights from our team of experts, and find out more about RealBlocks!