What kind of property types are there, and how do they differ?

The real estate investment market is made up of multiple property types, varying in all shapes and sizes. We’ve detailed the different property types below:

Residential

Residential property is considered to be single-family homes. Between April 2016 and March 2017, foreign buyers and recent immigrants purchased an estimated $153.0 billion of residential property, which represents a 49% increase over 2016 (estimated $102.6 billion) and surpasses 2015 (estimated $103.9 billion) as the highest total surveyed by the National Association of Realtors.¹

Multifamily

Multifamily housing is considered to serve a residential purpose but having more than one residence. A prime example would apartment buildings — high rise, mid rise, garden/suburban. Multifamily is an enticing property type to invest in and is especially popular among foreign investors. In 2017, multifamily sales in the US accounted for nearly an estimated $140 billion.²

Office

Offices serve a variety of clientele and businesses, including medical, government, or finance. These buildings are further classified by quality and location into classes A, B, and C. In 2017, office properties within the US accounted for approximately $123 billion in sales.³

Retail

Retail properties sell consumer goods and services. Examples include shops, restaurants, bars, or convenience stores. With technology allowing for goods and services to be purchased from your couch, there is much speculation in the market on the direction of the retail sector. Despite this, there was over $50 billion worth of retail properties transacted upon in 2017.⁴

Industrial

These properties are used for industrial purposes and exist in a variety of sizes. A few examples include warehouses, self storage, distribution centers, and flex (mixture of industrial and office). Since the recession ended, demand for industrial property has been ascending and continues to do so. As a much sought after product, investors have also been acquiring land in order to develop industrial property. Investment sales of industrial properties accounted for almost an estimated $60 billion in 2017.⁵

Hospitality

Hospitality covers properties considered to have a lodging component. Some examples include hotels, motels, resorts, or bed and breakfasts. Hotels tend to be the longest to construct than other commercial properties. In 2017, there were an estimated $24 billion worth of hospitality investment sales. Given the trend toward increasing technology providing alternative solutions to traditional hospitality, we believe this will be a fascinating industry to observe in the coming years.⁶

Mixed Use

Mixed Use properties contain a combination of the above property types. For example, a mixed use property may have retail on the bottom floor and apartment units on the floors above.

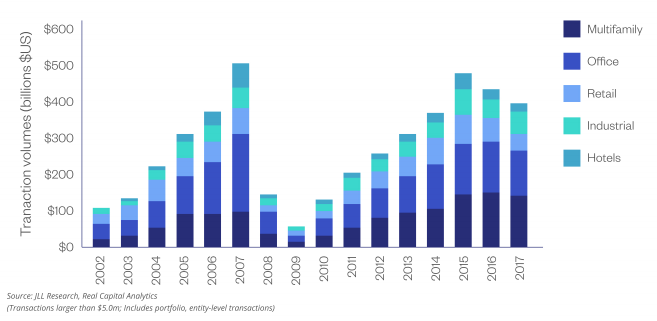

The United States is by far the largest market for commercial real estate investment. As depicted in the graph, transactions larger than $5M accounted for nearly $400B worth of investment sales in 2017. (Source JLL Research)